Articles

Business Case for Carrier Wi-Fi Offload

4GTrends.com

(May 17, 2012) 3G, 4G, LTE, Offload, Wi-Fi

Written By Haig A. Sarkissian and Randall Schwartz

Operators of 3G and 4G cellular data networks face an uphill battle against rapidly increasing data usage and declining ARPU. Increased sales of iPhones, Android smartphones, tablets and notebooks with embedded 3G/4G capabilities are all taxing the macro networks for scarce capacity resources. This exponential growth of data traffic is forcing operators to evaluate mid to long term migration strategies to LTE while in need for short term strategies to relieve their congested macro networks. On top of these clear and present dangers to the day-to-day operations of the network, operators are faced with increased scrutiny from shareholders to prove that a pure LTE overlay deployment will provide a positive ROI as well as an improved customer experience.

One method that is getting the most attention for managing the mobile data tsunami is Wi-Fi Offloading. Recent market research indicates that even though very few dedicated carrier Wi-Fi offload networks exist, a lot of data traffic is already being offloaded to existing private and public Wi-Fi networks in homes, at work and public hotspots. Research companies Comscore and Heavy Reading estimate that between 20%-80% of smartphone mobile data traffic traverse these private/public Wi-Fi networks. Several network equipment vendors are rushing to develop carrier-grade Wi-Fi infrastructure solutions, while MNOs are analyzing how to integrate Wi-Fi capabilities into their networks in order to offload data traffic from their primary 3G/4G network. But there has been a lack of analysis to examine where, when, and if using Wi-Fi offload actually helps an operator’s business case.

Wireless 20|20 developed the WiROI™ Wi-Fi Offloading Business Case Tool to offer the ability to analyze the economic tradeoffs of deploying a Wi-Fi offload network compared to expanding capacity by deploying primary 3G/4G network hardware. Wireless 20|20 has developed over 60 business cases using the WiROI™ for clients all over the world. In typical mobile broadband deployments, most urban networks quickly become capacity limited as opposed to coverage limited, especially in urban areas. This WiROI™Tool enables MNOs to analyze the conditions where Wi-Fi deployment can help the operator’s business case, determine the investments required, and optimize the configuration of the Wi-Fi offload network to maximize return on investment (ROI).

Wireless 20|20 conducted an analysis of two 4G-LTE deployments and examined the impact of Wi-Fi offloading; one in the dense urban market of New York City and the second case in San Diego with less population density. This analysis highlights the difference in the impact of a Wi-Fi offload network on the business case in a large dense urban market versus a midsized urban market. Although both markets would benefit from implementing a carrier Wi-Fi offload network, the economic impact on the business case and the optimum configuration for the Wi-Fi network varied dramatically. Using the WiROI™ Tool operators can pinpoint the combination of coverage and density of access points (APs) that will provide the maximum ROI.

The key findings from these analyses show that OpEx related costs, such as the monthly site rental and backhaul expenses, determine the viability of a Wi-Fi offload network. The New York and San Diego analyses conclude that a Wi-Fi offload network with OpEx less than $40 per month per access point is highly attractive, but if monthly OpEx per AP exceeds $100, the business case becomes challenging.. The case studies have shown that the most critical parameters of the business case are the assumptions around OpEx for the Wi-Fi offload network. Therefore, it is important to achieve the right balance of Wi-Fi coverage area and the density of APs in order to offload the optimum amount of traffic while maintaining or improving the user experience. Implementing too few access points could result in not capturing enough data traffic. On the other hand, implementing too many access points per square kilometer could increase OpEx significantly and drive the business case into negative ROI.

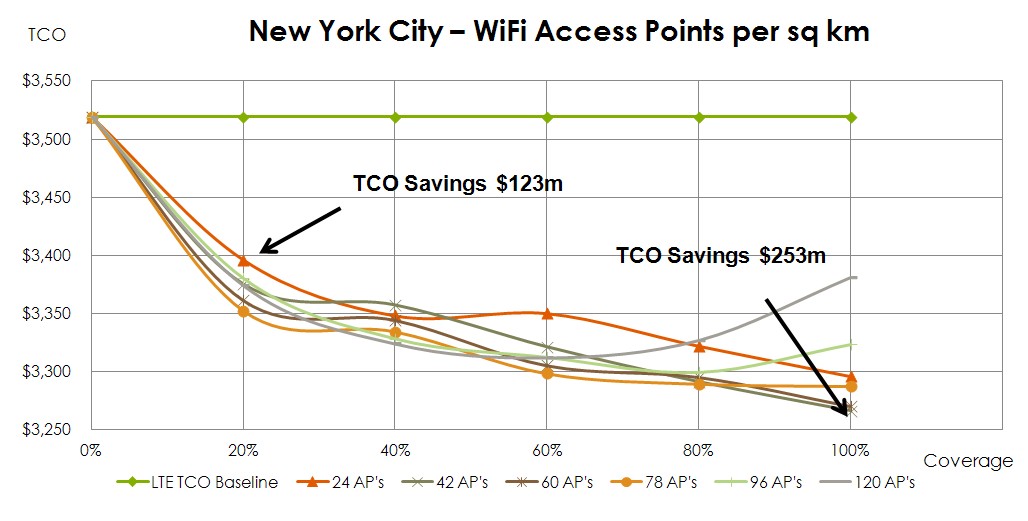

In a dense urban environment with a high traffic profile, such as New York City, Wi-Fi Offload is optimal at 100% coverage with a density of 42 APs per square kilometer, but a significant TCO reduction and positive ROI can be realized with as little as 20% coverage and a density of 24 APs per square kilometer.

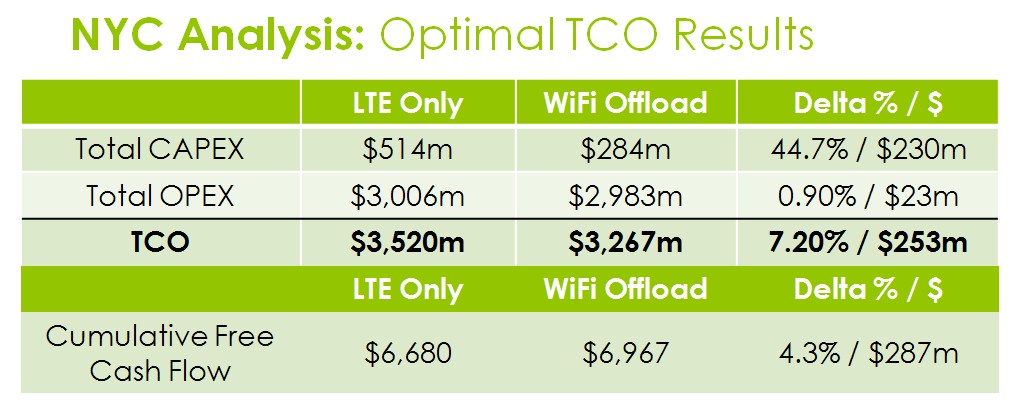

By deploying a Wi-Fi offload network at this optimal balance between coverage and density, the operator would reduce the number of macro LTE capacity sites from 1,879 to 432, a saving of 1,447 LTE sites. In financial terms, this translates into a cumulative TCO savings of over $250M, a significant 7.2% reduction in the TCO over 10 years. Cumulative cash flow is improved by 4.3%, or $287 million over a 10-year period.

Analyzing the numbers further, the cumulative CapEx is reduced by 44.7%, or $230 million while the cumulative OpEx reduction is a moderate 0.9%, or $23 million over the 10 year period. It should be noted that in theNew Yorkcase, a very dense urban area, an operator would start to see significant TCO improvement at 20% Wi-Fi coverage leaving the operator great flexibility in its Wi-Fi offload network implementation.

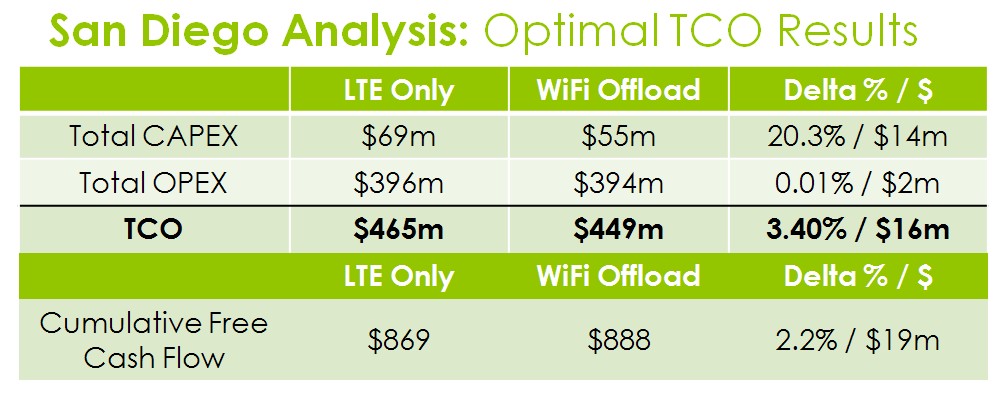

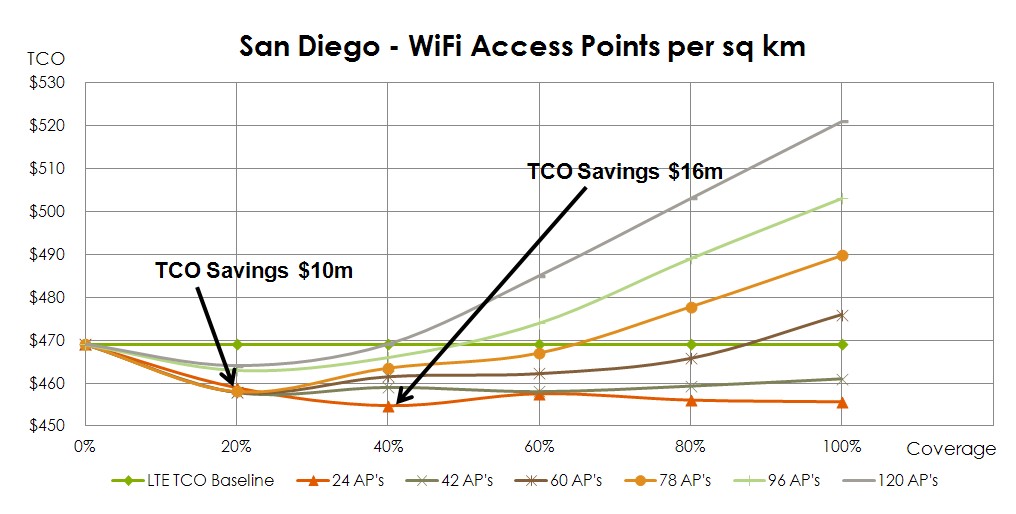

In less dense markets such as San Diego, the case for Wi-Fi offload is not as straight forward as the optimal scenario where there is 40% Wi-Fi coverage with a density of 24 APs per square kilometer. TheSan Diegocase shows that a detailed analysis can pinpoint an optimum balance of coverage and density of Wi-Fi offload for maximum ROI.

Deploying beyond 40% coverage or a density over 24 AP’s per square kilometer will result in a negative impact on the business case, increasing TCO beyond the baseline case of a 4G-only deployment. The analysis reveals that there are cases where deploying too many APs can actually hurt the business case.

In San Diego, the macro LTE network will need 69 coverage sites and 206 capacity sites. In this scenario, the analysis pinpoints the optimal Wi-Fi offload coverage to 40% coverage with a density of only 24 access points per square kilometer. The overall financial improvements are less impressive than in theNew York Citycase, but still yield a cumulative CapEx reduction of 20.3%, or $14 million, and cumulative OpEx savings of $2 million over the 10-year period. If coverage is increased beyond 80%, or the access point density is over 42 access points per square kilometer, the TCO increases above the baseline cost of a 4G only network.

Although every market is different and has its own unique parameters, Wi-Fi offload could have a positive impact on many operators’ business cases. Operators need to build a customized business case for their specific markets in order to analyze the exact parameters which yield an optimized ROI for the deployment of a carrier Wi-Fi offload solution. The WiROI™ Tool allows operators to simulate and adjust the coverage range of the access point, the coverage area percentage and the access point density which impact the total number of access points being deployed. This simulation capability allows operators to pinpoint the optimal configuration and help reduce CapEx and OpEx in order to greatly enhance the financial results over the timeframe of the business case. Depending on the assumptions made for a particular case, the results could be very different, so operators should conduct a detailed analysis before deploying a Wi-Fi offload network.

WiROI™ is a trademark of Wireless 20|20, LLC. WiMAX™ is a trademark of the WiMAX Forum®.

All others are trademarks of their respective Companies. This information is subject to change without notice.