Articles

A Comprehensive WiMAX™ Operator Business Case Process

Written by Haig Sarkissian and Randall Schwartz

Abstract

Developing a WiMAX™ business case could be a complex and time-consuming process. Yet the need to determine the CapEx, OpEx and ROI is critical to any deployment. Promptly analyzing over 250 input variables, easily modifying these variables, testing key assumptions, and instantly visualizing their impact on a WiMAX™ business plan are invaluable capabilities. This white paper provides a step-by-step guide to a comprehensive WiMAX™ operator business case process and describes Wireless 20/20’s WiROI™ Business Case Analysis Tool, which offers a range of capabilities to simplify and accelerate the process of building WiMAX™ business cases.

Introduction

The WiMAX™ Industry has seen much enthusiasm in the last two years, as measured by the number of field trials taking place on a global basis. The industry claims well over 300 trials worldwide. High profile trials and a few early deployments have dominated the media. These include WiMAX™ networks by Sprint and Clearwire in the USA and WiBro service in South Korea. Full commercial deployments, however, have been lagging the number of trials. This has been the source of major frustration to equipment vendors who have been planting seeds for many years and are waiting for their fruition.

The WiMAX™ industry cannot sustain itself on trials. Full deployments are critical for the success of WiMAX™ as an industry. Many licensees and operators need an objective WiMAX™ business modeling process to develop, evaluate and optimize their business cases in order to get funding for full deployment. A comprehensive business planning process will allow an operator to understand its capital needs, outline its service offerings, create its revenue profile, and recognize the critical success factors. Prospective WiMAX™ operators must clearly and confidently articulate their ROI proposition to their investors before full commercial deployments are funded.

A comprehensive WiMAX™ operator business planning process comprises of three main parts as follows:

Part 1 – Gathering the Input Parameters for a WiMAX™ Business Case

Part 2 – Service and Market Planning for a WiMAX™ Business Case

Part 3 – Optimization and Sensitivity Analysis of a WiMAX™ Business Case

Part 1 of 3

Gathering the Input Parameters for a WiMAX™ Business Case

The first step in this process is to gather all the relevant input to a business case. As inputs may vary significantly from country to country, each WiMAX™ network deployment will undoubtedly manifest itself as a unique set of financial, technical and business parameters that need to be modeled and analyzed. We will outline a step by step process for gathering these input parameters.

Step 1 – Gather the Target Market Statistics.

This includes a definition of the geographic area where service will be offered. Typically, this is measured by square kilometers of coverage for urban, suburban and rural geographies. For each of these geographic areas, specify the total population by individuals, number of households and the number of small and medium businesses (SMEs). Finally, a determination of the terrain type must be made. For signal propagation purposes, typical classification of terrain types is flat, moderately hilly or hilly. These are the terrain definitions specified in the Erceg-Greenstein channel models used by the IEEE to evaluate WiMAX™ technology options.

Step 2 – Determine the Spectrum & Bandwidth to Be Used.

Since we are concentrating on a WiMAX™ business case for licensed spectrum, the frequency spectrum is unquestionably the prime asset of an operator. In some cases an operator may be putting together a business case in order to determine how much to bid for a license and what bandwidth would be necessary to support a long term network operation. In either case, a comprehensive business case exercise is critical. How would the use of 2.3 GHz, 2.5 GHz or 3.5 GHz spectrum or even 1.7 GHz or 700 MHz range affect the business case results? Determining not only the available spectrum, but also the total bandwidth available are critical inputs to the business case. With this information, we can decide whether to use a channel bandwidth of 5 MHz, 10 MHz or 20 MHz. For those operators who already own spectrum, the cost of the licensed spectrum and whether a lump sum or a lease need to be specified.

Step 3 – Determine the Technological Parameters to Calculate Range and Capacity.

When contemplating a WiMAX™ deployment, the first technological selection is between 802.16d or the 802.16e standard. This, together with other technical parameters such as link budget, spectral efficiency and antenna configuration (SISO, MIMO & AAS), will be used to calculate the range and capacity of cell sites. These parameters, along with the frequency used, will predominantly control the coverage area per cell site and thus the total number of cell sites to cover the desired geography.

Step 4 – Customize Financial Assumptions.

For each operator deployment, the financial assumptions and parameters need to be customized. The interest rates on borrowing and return on cash capital need to be determined. The tax rate on corporate profit as well as taxes on revenue, if any, is specified as a part of the financial assumptions. Finally, depreciation and amortization period are specified.

Step 5 – Determine CapEx Assumptions.

Capital expenditures consist of the cost to acquire or lease sites. These may be existing sites through collocation agreements or Greenfield sites. There may be fixed costs as well as monthly recurring costs associated with site acquisition. The Access Network assumptions are next. These include not only the cost of the base stations, but also the cost to install and connect every component in the access network, from cabling to antennae to power and backhaul. The costs for backhaul provisioning, installation and operation also need to be considered. In developed regions, T1 or fiber may be readily available. Wireless backhaul links may also be considered. In this case, more capital will be invested in equipment, but operational costs will be eliminated. Figure 1 shows a diagram of a WiMAX™ network.

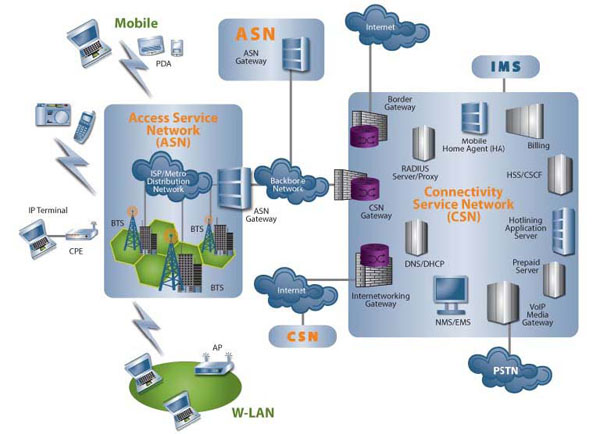

Figure 1. Block Diagram of a WiMAX™ Access and Core Networks

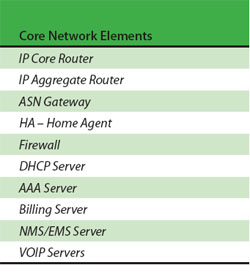

Once the access network parameters are specified, the cell cites are connected through the backhaul links to aggregators and then to the Access Services Network (ASN) gateway. These gateways in turn connect to the rest of the servers in a core network. Table 1 shows the elements of a core network. The features, capacity and performance parameters, as well as the cost of each component in the access network, the backhaul and the core network, need to be accurately specified in order to get a realistic determination of the CapEx requirements in the business case. Finally, an annual maintenance fee should be specified to sustain the network. This is typically a percentage of the total cumulative CapEx on an annual basis.

Table 1. WiMAX™ Core Network Components

Part 1 Conclusion

In this first part of the WiMAX™ operator business case development process, the goal has been to adequately define all of the necessary input parameters. This forms the cornerstone of the investment structure for bringing the network into service. Once the cornerstone has been laid, an operator can move on to the definition of the services that will be offered and sketch the plan for bringing those services to customers.

WiROI™ is a trademark of Wireless 20|20, LLC. WiMAX™ is a trademark of the WiMAX Forum®.

All others are trademarks of their respective Companies. This information is subject to change without notice.