Articles

A Comprehensive WiMAX™ Operator Business Case Process

Written by Haig Sarkissian and Randall Schwartz

Abstract

Developing a WiMAX™ business case could be a complex and time-consuming process. Yet the need to determine the CapEx, OpEx and ROI is critical to any deployment. Promptly analyzing over 250 input variables, easily modifying these variables, testing key assumptions, and instantly visualizing their impact on a WiMAX™ business plan are invaluable capabilities. This white paper provides a step-by-step guide to a comprehensive WiMAX™ operator business case process and describes Wireless 20/20’s WiROI™ Business Case Analysis Tool, which offers a range of capabilities to simplify and accelerate the process of building WiMAX™ business cases.

Introduction

The WiMAX™ industry has seen much enthusiasm in the last two years, as measured by the number of field trials taking place on a global basis. The industry claims well over 300 trials worldwide. High profile trials and a few early deployments have dominated the media. These include WiMAX™ networks by Sprint and Clearwire in the USA and WiBro service in South Korea. Full commercial deployments, however, have been lagging the number of trials. This has been the source of major frustration to equipment vendors who have been planting seeds for many years and are waiting for their fruition.

The WiMAX™ industry cannot sustain itself on trials. Full deployments are critical for the success of WiMAX™ as an industry. Many licensees and operators need an objective WiMAX™ business modeling process to develop, evaluate and optimize their business cases in order to get funding for full deployment. A comprehensive business planning process will allow an operator to understand its capital needs, outline its service offerings, create its revenue profile, and recognize the critical success factors. Prospective WiMAX™ operators must clearly and confidently articulate their ROI proposition to their investors before full commercial deployments are funded.

A comprehensive WiMAX™ operator business planning process comprises of three main parts as follows:

Part 1 – Gathering the Input Parameters for a WiMAX™ Business Case

Part 2 – Service and Market Planning for a WiMAX™ Business Case

Part 3 – Optimization and Sensitivity Analysis of a WiMAX™ Business Case

Part 2 of 3

Service and Market Planning for a WiMAX™ Business Case

Despite the enormous pent up demand for broadband wireless services worldwide, the broadband wireless market is still in its infancy, with relatively few operators realizing significant services revenue. This market is expected to expand significantly in the coming years due to the availability of a variety of fixed, portable and mobile WiMAX™ devices coming to the market, and to the anticipation that many of the WiMAX™ operators conducting trials will be able to construct convincing and bankable business cases in order to move from the trial stages to full network deployment. One of the most critical aspects of building these bankable business cases is the process of meticulously constructing the marketing model that will create the revenue profile needed to fuel a business case.

Business cases for these emerging services will be based on revenues from competitive, traditional broadband services to residential and business customers, and new mobility-based services enabled by new applications and devices. The broadband wireless services, as well as service pricing offered by WiMAX™ operators around the world, will vary significantly from region to region. An operator must understand the market conditions in its local markets which will drive its pricing, service packages, network coverage, roll out plans, and penetration estimates which in turn will drive its business case. For example, a 1 Mbps wireless broadband service in a particular city will be priced according to the supply and demand dynamics of that particular geographic area. Socioeconomic, regulatory and competitive elements are unique to each particular region and will greatly impact the supply and demand dynamics for broadband access. In this paper, we will outline a systematic approach to building a market model for an operator’s market and defining the types of potential services a WiMAX™ network operator can use to build the layers of revenue that drive a WiMAX™ business case.

Building a Broadband Market Model - There are several steps to follow in order to build an accurate model for market penetration of broadband wireless services into an operator’s market.

Market Planning

Competitive Analysis

While many markets have some level of broadband services available, penetration and pricing levels vary greatly. An operator must understand both current providers of wire-line broadband and future competitors offering wireless broadband services. These could include DSL and cable providers on the wire-line side. Wireless providers could include 3G service providers, metro WiFi providers, unlicensed wireless ISPs, or other holders of broadband licenses. Further consideration should be given to the licenses held by the operator and competitors. An operator that holds a 3.5 GHz license will likely need to focus on fixed services and will need to deploy more base stations to cover a given area as compared to a holder of 2.5GHZ license, leading to a higher cost base. A complete understanding of the competitive environment for broadband services in an operator’s market is the first step in developing a market plan.

Coverage Roll Out Plan

An operator must develop a plan for rolling out coverage by addressing such questions as: Whom do you want to serve? Do you want or need ubiquitous coverage? Is it best to roll out coverage quickly or take a slow roll out approach? Who are your most valued customers and where are they? A detailed study is necessary to set the geographic boundaries of what typically is a multi-stage roll out. This is an area where a comprehensive business case analysis tool such as the Wireless 20/20’s WiROI™ Business Case Analysis Tool will allow you to do the scenario planning necessary to evaluate the many options for a network roll out strategy.

Penetration

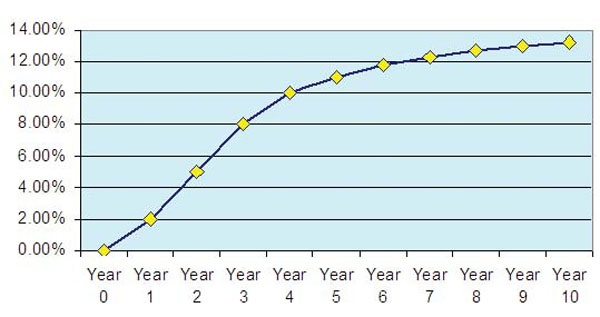

When building a WiMAX™ business case, one of the most challenging tasks is to forecast the number of subscribers that an operator can expect to sign over the life of the network. The plot of number of subscribers over a 10 year time frame is often called the S curve. This is because the shape of the curve looks like an S with relatively few subscribers in the first couple of years, as the operator is deploying the network, expanding coverage, and establishing brand recognition. Once the network is fully deployed, there will be a rapid increase in subscribers until a level of saturation is reached.

The following table shows a typical S curve:

Figure 2. Penetration Curve

These types of service will contribute to lowering the monthly churn for WiMAX™ operators.

Determining the S curve for a particular WiMAX™ deployment is often the outcome of extensive market research and competitive analysis that includes an assessment of the existing broadband, PSTN, Cellular and VoIP competitive dynamics.

Service Planning

Next, an operator should define what services they would like to offer. We define several types of services that a WiMAX™ operator can consider offering. These include Broadband Access, VoIP, Value Added Wireless Service and Advertising.

Broadband Wireless Access

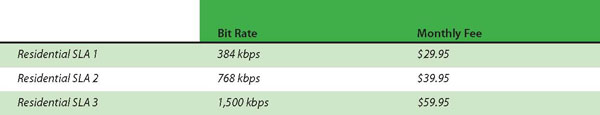

WiMAX™ promises a dramatic decrease in the price per megabit of broadband wireless access (BWA). This, along with the ability to rapidly deploy WiMAX™ networks and offer plug-and-play portable and mobile wireless services, will give new WiMAX™ operators a competitive advantage. BWA will constitute the bulk of most WiMAX™ operators’ revenue in the early years of a business case. The two main categories of BWA service are Residential BWA and Business BWA. These are essentially high speed, “dumb-pipe” connections to the Internet. An operator will need to determine how many residential service level agreements (SLA) to offer. An SLA is a negotiated agreement between a service provider and a consumer. It is a subscription choice which typically defines the service level offered (i.e. a bit rate) for a given monthly fee. For example, a typical entry level residential SLA could be offered at 384 Kbps for $29.95 per month. The following table illustrates an example set of residential SLAs a WiMAX™ Operator may choose to offer:

Table 2. Example Set of Residential SLAs

Most operators will likely offer a couple of residential SLAs to give their consumers a choice of service and price while positioning their offering according to the competitive landscape in their particular market. For instance, in a market where wired broadband access using DSL or Cable networks have limited coverage, a WiMAX™ operator will price its service based on the pent-up demand for BWA. In most developing countries where wired broadband access is limited and where PC penetration is growing, these PCs use dial-up service at 56 kbps. Here, a 384 kbps service will look attractive. In other countries where DSL & Cable service is ubiquitous and the competitive environment has put pressures on prices, an operator has to carefully analyze the market prior to determining what would constitute a winning offer for a given market.

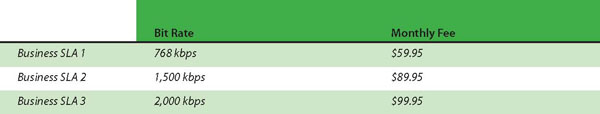

A similar set of SLAs are developed for the business market. In most cases, business SLAs should be able to command higher prices and will require a higher guarantee of availability and throughput. The following table illustrates an example set of business SLAs a WiMAX™ Operator may choose to offer:

Table 3. Example Set of Business SLAs

Oversubscription – WiMAX™ operators will have to determine the extent to which they should oversubscribe their networks. The term oversubscription is used to mean assigning a total committed information rate to a given base station that is greater than that base station’s maximum capacity. This number is used to calculate “busy hour” traffic in order to determine the traffic capacity of the network needed to support the anticipated number of users. As the number of users increases, a calculation using the oversubscription rate will tell an operator when to add cells for capacity. Again, a good business planning tool will provide this information to a network planner. Typical oversubscription rates are 25-40 for residential service and 10-15 for business service.

Unlimited vs. Usage Based Rates – In the USA, and Western Europe, WiMAX™ SLAs will often be offered with unlimited usage for data. In some cases, however, there will be a need to establish the maximum amount of data usage per month. As a result, most ISPs and international WiMAX™ operators will be faced with the fees for International Internet Connection. These fees are usage based fees that a WiMAX™ operator will incur. Therefore, an operator must include this not only in the OpEx analysis but also when pricing the SLAs. A comprehensive business case tool would provide cost per bit metrics in order to enable the operator to make informed pricing decisions.

Ad Hoc Services

Another way for an operator to build layers of revenue is to offer ad hoc WiMAX™ services for users who happen to roam into a coverage area. This model is very similar to the Wi-Fi hotspot model, where a user would pay $9.95 for one day’s Wi-Fi access at a hotel.

VoIP

VoIP over WiMAX™ is expected to become one of the most popular value added service that a WiMAX™ operator would offer in order to derive another “layer of revenue.” The decisions for a WiMAX™ Business Case include the recurring cost for offering VoIP service, PSTN termination charges, CPE types and costs, as well as utilizing the flat rate vs. the fee based approach for pricing VoIP service. VoIP service will typically be offered in conjunction with one of the residential or business SLAs discussed above.

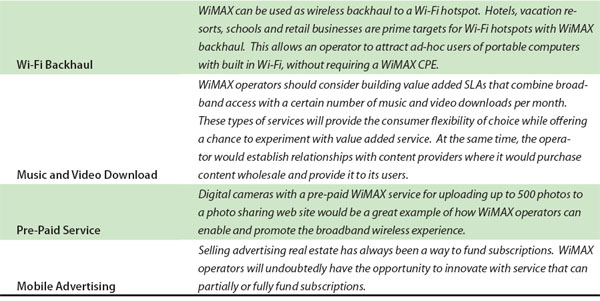

Value Added Services

There is a list of additional value added services that a WiMAX™ operator should consider offering. Below are a few examples:

Table 4. Example Set of Value Added Services

These types of service will contribute to lowering the monthly churn for WiMAX™ operators.

Determining the S curve for a particular WiMAX™ deployment is often the outcome of extensive market research and competitive analysis that includes an assessment of the existing broadband, PSTN, Cellular and VoIP competitive dynamics.

CPE Assumptions

Another important element of an operator business case process is to establish the various types of subscriber stations or WiMAX™ terminals used with the various SLAs. The following list illustrates some of the options:

- Fixed CPEs (indoor and outdoor)

- Portable CPEs

- Mobile CPEs

- WiMAX™ PC Cards

- WiMAX™ cards Integrated in laptops

- WiMAX™ Embedded in consumer electronic (CE) devices such as Portable Media Players (PMPs), digital cameras, gaming, and other CE devices.

Lastly, with each CPE, the business case should include the price of the CPE, whether it is being subsidized by the operator, the price erosion per year for the 10 year forecast period, the installation cost, along with whether the installation is being subsidizes by the operator or paid by the consumer. Operators planning to offer WiMAX™ smart phones may also wish to consider the need and impact of the “refresh cycle.” This is when an operator provides significant incentives for subscribers who have completed their contract term and would like to receive a new device.

Part 2 Conclusion

In the first part of the WiMAX™ operator business case development process, we outlined all of the necessary input parameters for a WiMAX™ operator business plan.

In this second part of the WiMAX™ operator business case development process, the goal has been to outline how to build layers of revenue by defining a number of service level agreements and value added services that will generate the top line revenue for the business. This forms the cornerstone of the revenue structure for the business case. Once the cornerstone has been laid, an operator can move on to optimizing the business case.

WiROI™ is a trademark of Wireless 20|20, LLC. WiMAX™ is a trademark of the WiMAX Forum®.

All others are trademarks of their respective Companies. This information is subject to change without notice.