Articles

What is the Potential ROI from AI in 5G Wireless Networks?

wireless2020.com

January 15, 2019

Written by Berge Ayvazian, Senior Analysts and Principal Consultant, and Randall Schwartz, Principal Consultant, Wireless 20/20.

Analyst Angle: What spectrum bands will US operators use for Mobile 5G?

Although much of the dialogue on 5G spectrum in the US has focused on millimeter (mmWave) spectrum, it is not clear whether the mmWave spectrum is suitable for mobile network deployment in the near to mid-term future.

rcrwireless.com

December 22, 2017

Written by Haig Sarkissian, Principal Consultant, Wireless 20/20.

This is exactly why Verizon is concentrating on the Fixed Wireless Access use case in order to develop an ecosystem of vendors to advance mmWave technology and showcase the building blocks that will ultimately be necessary for the commercial deployment of mobile 5G. The array of technologies that need to be developed, miniaturized and optimized include antenna technology, RF front-end circuits, including mmWave power amplifiers and filters, as well as the associated PHY and MAC digital circuitry capable of utilizing mmWave for the over-the-air interface. All this has to ultimately be developed in low power semiconductor technology for integration in handheld, battery operated smartphones.

For now, the 5G Fixed Wireless Access use case is an ideal application to enable the industry to develop and test many of the piece-parts that will ultimately be integrated into smartphones. Most industry analysts and observers will agree that it is unlikely to see wwWave 5G technology integrated into smartphones in the next two years. Low-band wireless signals travel further and penetrate obstacles like buildings better than the mid-band and high-band spectrum. But if the Mobile 5G promise is to be met by the 2020 timeframe, sub-6 GHz spectrum will be necessary.

FCC Investing In Mobile 5G Wireless Future

Forbes.com

November 20, 2017

By Fred Campbell, CONTRIBUTOR and the Director of Tech Knowledge, a Senior Policy Advisor with Wireless 20/20

The world is in a race to deploy the next generation of wireless technology, known as “fifth generation” or “5G”, which promises ultra-high mobile internet speeds and greater capacity. The U.S. won the race to 4G, the current generation of mobile tech, but many fear the Chinese could beat us to 5G. To win this heat, the Federal Communications Commission must make available the spectrum (or airwaves) that 5G technologies need.

The agency recognizes the importance of its role in the 5G race and is working hard to meet 5G spectrum needs. Last week the FCC added 1.7 GHz of spectrum to our nation’s 5G inventory in high frequency bands, and it’s seeking to increase the usability of additional spectrum for 5G in the mid frequency 3.5 GHz band using rules that proved successful in the race to 4G.

The current rules for the 3.5 GHz band weren’t intended to promote investment in 5G mobile networks. The FCC adopted a set of rules for the 3.5 GHz band during the Obama Administration that emphasized experimental uses of spectrum while discouraging investment in reliable 5G networks, especially in rural areas.

Wireless 20/20 Scorecard for Evaluating Responses to Public Safety Network RFPs

wireless2020.com

October 23, 2017

By Berge Ayvazian, Senior Consultant with Wireless 20/20

Over the next 6-8 weeks, the governors of all 50 States and territories will have a critical decision to make – what public safety interoperable network solution will be deployed in their state and operated for the next 25 years? Wireless 20/20 has published a new white paper What Should States Look for in Responses to Public Safety Network RFPs in order to address this vital decision.

In a prior White Paper, Wireless 20/20 recommended that states conduct RFPs over the next 6-8 months by June 28, 2018, when a final decision has to be made.

By issuing an RFP, states are able to define their needs, make their demands known and review competitive bids. Any state that does not explore its options regarding FirstNet is doing a great disservice to its constituents and First Responders. Only by issuing an RFP, can states 'take control of their own destiny' in getting the coverage, capacity, service quality, low cost and revenue sharing potential made possible by FirstNet. States should not be rushed to accept the initial proposals made by FirstNet to serve their public safety needs for the next 25 years.

Wireless 20/20 reviewed several FirstNet RFPs and conducted interviews with several state POCs to identify best practices for evaluating State Public Safety proposals, and devise a "scorecard" of criteria for evaluating alternate proposals versus AT&T/FirstNet plans. In our new white paper, Wireless 20/20 provides 12 key factors and criteria that a state should evaluate as part of the RFP process and while making their decision. These criteria include Band 14 network coverage, public safety network capacity, priority and pre-emption, service quality and QoS, network quality and resilience, use of local partners, cost of service, financial considerations, new jobs created, and the ability to address risk factors and technology evolution during the next 25 years.

|

Editorial Report: Ultra High Speed Fixed Broadband: The First Phase of 5G

The commercialization of 5G technology and use cases won't be like turning on a light, rather it will be a more gradual, phased approach. Early consensus suggests the first wave of 5G deployments may center around ultra-high-speed fixed broadband. Learn about the trials and testing that could ultimately bring multi-gigabit internet speeds into homes and businesses around the world, as well as how consumers and enterprises can leverage this new level of connectivity.

What you will learn:

- The hardware components of 5G fixed wireless access.

- The key role of test and measurement in 5G fixed wireless access using high-band spectrum.

- Why fixed wireless access could be a workable alternative to investing in and deploying fiber.

- Why have carriers, particularly in the U.S., taken such a keen interest in 5G fixed wireless access.

- How does 5G fixed wireless access relate to mobile 5G?

Fixed Wireless Revival: 4G LTE for Broadband in Rural Communities

KNect365.com

May 4, 2017

By Berge Ayvazian, Senior Consultant with Wireless 20/20

We have seen a significant uptick in interest and investment in fixed wireless broadband over the past few months. Approximately 30% of US households in remote and rural communities still lack access to high speed broadband, and availability of fixed terrestrial broadband services in rural America continues to lag behind urban and suburban areas at all speeds. High speed internet access via DSL, cable and fiber is still cost prohibitive in rural and remote areas, and is available is only where providers can deploy these networks profitably. Fixed wireless broadband is a key technology enabler in rural areas where communities are small and housing density is low.

Approximately 2,000 WISPs currently fill this gap by providing fixed wireless broadband services to more than 4 million households in small towns and rural communities in all 50 US states. Although the WISP industry is still highly fragmented, consolidation among WISP has been accelerating, as Rise Broadband acquired 100+ smaller operators since its founding in 2006. Rise Broadband is the largest US WISP with approximately 200,000 subscribers in 16 western states. SpeedConnect, the next largest WISP, serves 50,000 subscribers in 10 mid-west and southern states. Although the majority of these subscribers are being served using proprietary technologies in unlicensed 5GHz spectrum, the use of LTE technologies in licensed spectrum is growing.

Until recently, the largest US telecom and wireless network operators had not shown much interest in using fixed wireless technology to deliver fixed broadband to rural communities. But six of the leading telcos accepted more than $1.4 billion in funding in the second phase of the FCC Connect America Fund (CAF-II) to bring broadband to an estimated 3.5 million households and businesses in rural uncovered areas. Verizon opted out of the high-cost broadband program, while CAF II funding was accepted by CenturyLink, AT&T, Frontier, Windstream, FairPoint and Consolidated.

Google adds to a dampening forecast for next US spectrum auction

Mobile World Live

February 17, 2016

By Kavit Majithia, Content Editor, Mobile World Live

Google has decided to look on, but not touch, when vast amounts of 600MHz spectrum hits the shelves at the next Federal Communications Commission (FCC) run incentive auction, scheduled to kick off on 29 March.

The internet giant will “follow the upcoming spectrum auction closely”, but confirmed it will not participate, announcing the decision two days after prospective bidders filed their applications to the US regulator.

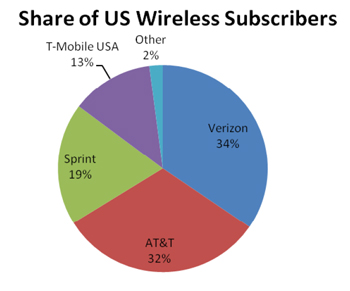

While not officially confirmed, heavy hitters like Verizon, AT&T, T-Mobile US and Comcast are almost certainly going to be involved, and a number of investment firms are also reportedly looking to cash in on the opportunity.

Tom Wheeler, FCC chairman, for a long time now has been particularly bullish about the potential of 600MHz, boldly predicting last month that the upcoming auction will be the largest sale of frequencies to date globally.

Analyst Angle: Shaw acquisition of Wind – a model for U.S. cablecos?

RCR Wireless News

January 20, 2016

By Berge Ayvazian, Randall Schwartz and Haig Sarkissian, Senior Analysts and Principal Consultants, Wireless 20/20

Shaw Communications agreed to acquire Wind Mobile in a deal worth approximately C$1.6 billion (around $1.16 billion USD). Headquartered in Calgary, Alberta, Shaw competes most directly with Telus and serves about 2.6 million cable TV, 2 million broadband Internet and 1.2 million digital telephone customers in British Columbia and Alberta, with smaller systems in Saskatchewan, Manitoba and Northern Ontario. While the acquisition awaits approval by Industry Canada and the Competition Bureau, Shaw has been working to arrange the financing necessary to complete the acquisition.

Financing the acquisition of Wind Mobile

Shaw recently announced an agreement to sell 100% of its wholly owned broadcasting subsidiary, Shaw Media, to Toronto-based Corus Entertainment in a cash and stock deal worth C$2.65 billion. The divestiture will fund the Shaw acquisition of Wind Mobile and give the combined company a cash injection needed to invest capital in improving and expanding the Wind Mobile network.

Analyst Angle: Preparing for the 600 MHz incentive auction

RCR Wireless News

January 13, 2016

By Berge Ayvazian and Haig Sarkissian, Senior Analysts and Principal Consultants, Wireless 20/20

Wireless 20/20 digs into preparations for the upcoming FCC 600 MHz incentive auction proceedings

It is time for bidders to start gearing up for the 600 MHz band incentive auction. This could be the last time a large block of valuable low-band spectrum will be up for sale in the foreseeable future. The Federal Communications Commission recently announced the schedule for the Broadcast Incentive Auction 1001. The deadline for broadcasters to file their initial Form 177 applications expressing their intent to participate in the reverse auction is Jan. 12. Each participating broadcaster that has completed an application must commit to whether it wants to sell all of its spectrum, engage in channel sharing or move to a lower channel or from a UHF to a VHF channel.

Having established the schedule and final procedures for the incentive auction, the FCC is now working to maximize the perceived value of this spectrum during the reverse auction in which broadcasters will offer to voluntarily relinquish some or all of their spectrum usage rights. Although the FCC has stated its central objective is to allow market forces to determine the highest price and best use of the 600 MHz spectrum, a final list of opening bid prices for the incentive auction has been released. The top opening bid price in the reverse auction, where broadcasters will sell spectrum to the FCC, has been set at $900 million for a station in the New York City metropolitan area.

Guest Blog: Neutral Host Networks are a Win-Win for MNOs and Venue Owners

Avren Events

January 8, 2016

By Randall Schwartz, Principal Consultant, Wireless 20/20

The development of Neutral Host Networks in key venues, is one of the most important trends in the broadband wireless industry today. As mobile operators expand and densify their 4G LTE networks, the need to provide in-building networks to supplement the outdoor macro network becomes more critical. To provide improved coverage in key venues, and to meet the ever-increasing capacity needs, operators want to cover venues such as airports, shopping malls, enterprise buildings, college campuses, stadiums and arenas, convention centers, hotels, transit systems and other public venues that have dense user populations. But as individual MNOs look to deploy their own solutions in a venue, the cost for providing this additional coverage may not justify the benefit for the improved service. Yet, if a third party can provide one shared infrastructure, such as DAS, small cells or Cloud RAN that can support all operators in a venue, the economics suddenly turn in favor of both the Neutral Host provider and the MNOs.

Several key trends contribute to the needs for improved wireless networks in-building. Eighty percent of traffic is generated indoors for MNOs. The expansion of BYOD usage in enterprise environments means that excellent mobile service is now a mission-critical requirement. Quality wireless service has become an expected feature in dense user environments such as stadiums, shopping malls, and airports. Venue owners have become more focused on the need, and the value of providing excellent wireless service throughout their venues. In many cases, this could be the difference between a renter coming to a building, or a patron selecting whether to visit a venue.

Analyst Angle: The Business Case for Neutral Host Networks in High-Traffic Venues

RCR Wireless News

December 23, 2015

By Berge Ayvazian, Senior Analyst – Wireless 20/20

Small cell and distributed antenna system networks have become important and fast growing complements to deploying new spectrum and adding additional macro towers as U.S. mobile operators are focused on densifying their networks in urban areas. Small cells are becoming more common as an attractive option to increase capacity and extend coverage outdoors, and distributed network solutions are becoming increasingly popular for enterprise buildings and high-traffic indoor venues. Although these markets are in their infancy, they are poised for rapid growth.

Business case for distributed networks deployments Wireless 20/20 has been examining the role of small cell and DAS as critical elements of mobile network densification. Our focus has been on the business case for various distributed network solutions in large venues such as stadiums, college campuses, enterprise buildings, hospitals, airports, shopping malls, train stations, subways and convention centers with a high density of broadband users. Wireless 20/20 showcased its new WiROI Neutral Host Network Venue Business Case Analysis Tool at the Tower & Small Cell Summit, co-located with CTIA Super Mobility 2015. Leveraging the in-depth knowledge garnered from over 100 engagements with 3G/4G operators worldwide, Wireless 20/20 has been using the new WiROI tool to analyze a wide range of distributed network solutions for various venue environments:

- Compare and analyze network technology options like Wi-Fi, DAS and LTE small cells.

- Conduct a complete return-on-investment analysis for venue owners, mobile network operators and neutral host providers.

- Model the service level agreements and cost savings under various business scenarios.

- Simulate various methods for monetizing the investment in venue networks.

- Help MNOs and venue owners analyze how to best partner with neutral host operators.

Unlimited Cellular Data Plans Can Be Unfair

Antenna Systems & Technology Magazine

December 16, 2014

GUEST BLOG By Haig Sarkissian – Wireless 20/20

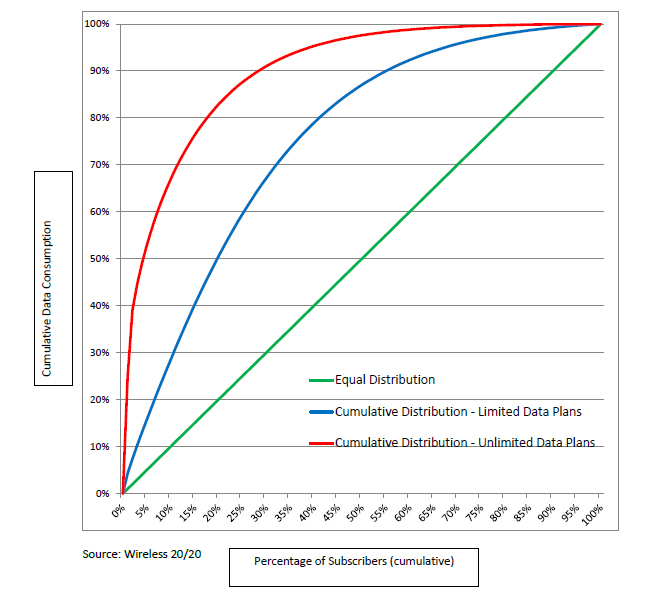

4G LTE networks are quickly becoming capacity limited for some operators. This means that in order to provide more bandwidth to subscribers, MNOs need to invest in building and expanding the capacity of their networks. As data usage grows, more investment will be needed in order to deliver more capacity.

CapEx and OpEx analysis performed using the WiROI Tool shows that on a capacity limited network, the cost per GByte delivered is very close to the cost per GByte available. As more capacity is added, the cost per GByte stabilizes and is nonzero. This realization leads many MNOs to abandon their unlimited data plans of the past and establish tiered, tonnage based plans, where users pays for the amount of data that they consume.

Telcos urged to innovate data tariffs to counter OTT threat

telecoms.com

(November 20, 2014)

Written by Tim Skinner, News & Analysis

At LTE North America in Dallas this week, a panel featuring Wireless 2020, IBM, Allot Communications and US-based MVNO FreedomPop urged the service provider community to develop more flexible and tailored data bundles for customers.

Where is Mobile Offload to Carrier Wi-Fi?

4GTrends.com

(August 1, 2014)

By Randall Schwartz – Prinicipal Consultant, Wireless 20/20

Over the last few years, there has been much discussion about major mobile network operators (MNOs) using Carrier Wi-Fi as a tool in their arsenal to provide broadband capacity to their customers. And yet we have seen very few actual agreements between Wi-Fi service providers and MNOs to augment the operator’s current capacity with third party Wi-Fi capacity. The need is there for additional wireless broadband capacity, and the need will continue to intensify. There are a number of operators that are building extensive Wi-Fi networks in the US, in part in anticipation that the MNOs will buy some of their capacity. But what will need to happen for Mobile Data Offload to Carrier Wi-Fi to actually take-off in the market, both as a revenue opportunity for Wi-Fi providers and as a network capacity tool that MNOs will take to heart as part of their capacity arsenal?

4G Network Deployment, Multimedia Value-Added Services and Spectrum Auctions In India

4GTrends.com

(February 3, 2014) 4G IN INDIA

By Berge Ayvazian – Senior Analyst, Wireless 20/20

As we begin 2014, India’s 4G operators are still in the network deployment phase. Bharti Airtel continues to rollout 4G networks across the country, with prepaid and postpaid LTE services already available in Chandigarh, Mohali and Panchkula in Punjab and Haryana, followed by Kolkata, Bengaluru and Pune. Airtel is expanding these 4G circles and is reported to be in talks with ZTE rolling out LTE networks in Delhi, Mumbai, Haryana and Kerala circles Airtel acquired from Qualcomm.

SoftBank Mobile Deploys Cloud RAN and Conducts TD-LTE Advanced Trial in 3.5 GHz Band

4GTrends.com

(September 10, 2013) TD-LTE

By Berge Ayvazian – Senior Analyst, Wireless 20/20

I recently participated in a field test drive demo conducted by Softbank Mobile of the world's first trial network supporting TD-LTE Advanced technology in the 3.5 GHz band. Driving through the crowded streets in Tokyo's densely populated Ginza district, I saw the density of SoftBank's network of rooftop LTE antennas, and witnessed a live measurement of average download speeds of 500 Mbit/s and peak download speed reaching 770 Mbit/s.

AT&T, Verizon, Sprint, T-Mobile USA: Who is the Richest of Them All?

Antenna Systems & Technology Magazine

August 19, 2013

GUEST BLOG By Haig Sarkissian – Wireless 20/20

The wealth of companies is often measured by such financial metrics as market cap, revenue or EBITDA. Financial executives seem to have had no shortage of metrics to measure how successful a company has been in creating shareholder value. They often use MVA (Market Values Added), which measures the amount of wealth a company has created since its inception.

Mobile Data Usage in Stadiums Gives a Glimpse of the Future

Antenna Systems & Technology Magazine

Caching Improves User Experience in 4G LTE Networks

Antenna Systems & Technology Magazine

(March 5, 2013) 4G LTE

Over the past few months I have been running speed tests on my new iPhone 5 smartphone on the Verizon 4G LTE network. I have frequently gotten 10 to 15 Mbps download speeds and 5 to 8 Mbps of upload speeds. Sometimes I have seen speeds approaching 20 Mbps downlink. Although these are fast and impressive by most standards, my mobile internet user experience has not improved significantly. I still have to wait for web pages to download and video clips to buffer.

Business Case for Carrier Wi-Fi Offload

4GTrends.com

(May 17, 2012) 3G , 4G , LTE , Offload , Wi-Fi

Written by Haig Sarkissian and Randall Schwartz

A Comprehensive WiMAX™ Operator Business Case Process

Written by Haig Sarkissian and Randall Schwartz

Part 1 of 3

Gathering the Input Parameters for a WiMAX™ Business Case

Wireless 20|20 - 2007

Part 2 of 3

Service and Market Planning for a WiMAX™ Business Case

Wireless 20|20 - 2007

Part 3 of 3

Optimization and Sensitivity Analysis of a WiMAX™ Business Case

Wireless 20|20 - 2007

Media Contact:

Robin Bestel

610-428-5845

robin@wireless2020.com

|

|